Discover why smart traders are making the switch to low-interest MTF on HDFC SKY by HDFC Securities. This modern discount-broking platform offers a range of investment options with competitive pricing and unique features like interest-bearing margin trading. Find out how HDFC SKY is revolutionizing the trading landscape for Indian investors.

Understanding MTF (Multilateral Trading Facility)

A Multilateral Trading Facility (MTF) is a type of trading platform that enables multiple market participants to come together and execute transactions. These platforms provide an alternative to traditional stock exchanges by offering increased transparency, efficiency, and cost-effectiveness. MTFs, such as HDFC SKY by HDFC Securities, play a crucial role in the modern financial ecosystem by enhancing liquidity, price discovery, and competition in the market. Investors can access a wide range of financial instruments, including equities, ETFs, mutual funds, derivatives, commodities, currencies, and global stocks on MTFs, allowing for diversified investment opportunities.

MTF calculator tools are invaluable for investors looking to optimize their trading strategies on Multilateral Trading Facilities. By providing detailed analyses of potential costs and returns, these calculators help investors make informed decisions. They offer insights into margin requirements and potential risks, ensuring that traders can navigate MTF platforms confidently and effectively.

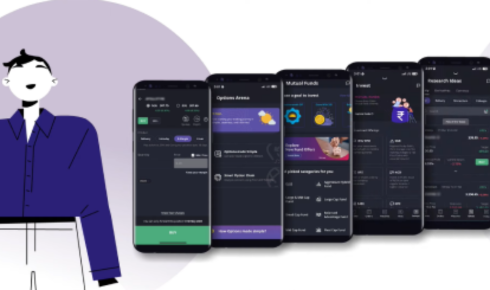

HDFC SKY, being a modern discount-broking platform, leverages the benefits of MTFs to provide seamless access to various financial products at competitive rates. With features like zero account-opening charges and flat brokerage fees per order, HDFC SKY aims to make investing more accessible and affordable for retail investors. Additionally, the platform offers interest-bearing margin trading, expert research, and intuitive tools to assist investors in making informed decisions. By utilizing the MTF structure, HDFC SKY enhances market efficiency, fosters price competition, and broadens investment options for individuals looking to build and manage their portfolios effectively.

Benefits of Low-Interest MTF for Traders

One of the significant benefits of low-interest Margin Trading Facility (MTF) for traders on platforms like HDFC SKY is the potential to amplify their trading capital. By utilizing margin trading to borrow funds at low-interest rates, traders can increase their buying power and take advantage of investment opportunities they might not have been able to access with their own capital alone. This can lead to higher potential returns on investments and the ability to diversify their portfolio more effectively. Additionally, the availability of interest-bearing margin trading allows traders to manage their borrowing costs more efficiently, particularly in fluctuating market conditions.

Another key advantage of low-interest MTF for traders is the flexibility it offers in managing their trading strategies. With access to affordable borrowing options, traders can adapt to market movements quickly and seize short-term trading opportunities without having to liquidate existing positions. This flexibility can be particularly beneficial in volatile markets where quick decision-making is crucial. Moreover, the low-interest rates on margin trading facilities can help traders reduce their overall trading costs, enhancing their profitability in the long run. Overall, low-interest MTF can empower traders with the tools and resources to optimize their trading performance and achieve their financial goals more effectively.

MTF on ETFs offers another dimension of trading strategy optimization. By using MTF for ETFs, traders can leverage the inherent diversification benefits of ETFs while still accessing additional capital. This approach can amplify returns on broad market trends, empowering traders with heightened flexibility and cost-effective leverage, enhancing their market position significantly.

How Low-Interest MTF Impacts Trading Strategies

A low-interest Margin Trading Facility (MTF) can have a significant impact on trading strategies for investors using platforms like HDFC SKY by HDFC Securities. With access to interest-bearing margin trading at lower rates, investors can leverage their capital more effectively to amplify potential returns. This enables traders to take on larger positions with a smaller initial investment, allowing for increased exposure to various asset classes such as equities, derivatives, and commodities. By using MTF, investors can capitalize on market opportunities more efficiently, leading to potential higher profits.

Furthermore, the availability of a low-interest MTF on HDFC SKY can also influence risk management strategies for traders. With the ability to borrow funds at lower interest rates, investors can better manage their risk exposure by hedging against potential losses. This can be particularly beneficial in volatile markets or when trading complex financial instruments. The lower cost of borrowing through MTF can also provide traders with more flexibility in adjusting their positions as market conditions change, enhancing their ability to protect their capital and optimize their overall trading performance.

Comparison of Low-Interest MTF vs. Traditional Trading Platforms

When comparing low-interest Margin Trading Facility (MTF) platforms like HDFC SKY with traditional trading platforms, several key differences come to light. One major advantage of low-interest MTF platforms is the cost-effectiveness they offer to traders. With zero account-opening charges and a flat brokerage fee per order, users can significantly reduce their trading costs compared to traditional platforms that often have higher fees. Additionally, the interest-bearing margin trading feature of HDFC SKY allows traders to leverage their investment capital effectively, enabling them to potentially maximize their returns.

Another key aspect of the comparison is the level of convenience and accessibility provided by low-interest MTF platforms. HDFC SKY’s offering of seamless access to a wide range of financial instruments, including equities, ETFs, mutual funds, IPOs, derivatives, commodities, currencies, and global stocks, gives traders the opportunity to diversify their portfolios easily. Moreover, the expert research and intuitive tools available on platforms like HDFC SKY can assist traders in making informed investment decisions. This accessibility and support can be a significant advantage over traditional trading platforms that may lack such comprehensive resources and features.

Regulatory Aspects of Low-Interest MTF

The regulatory aspects of a low-interest MTF like HDFC SKY by HDFC Securities play a crucial role in ensuring the platform operates within the boundaries of the law and protects the interests of investors. As a discount-broking platform offering a wide range of financial products, HDFC SKY must adhere to regulations set forth by the Securities and Exchange Board of India (SEBI) to maintain transparency, integrity, and fairness in its operations. SEBI regulations govern various aspects such as account opening procedures, brokerage charges, margin trading practices, and investment product offerings to safeguard the interests of investors and maintain market stability. Compliance with these regulations not only ensures the legality of the platform’s operations but also helps build trust among investors by demonstrating a commitment to ethical and responsible financial practices.

irfc share price can be influenced by a variety of factors including market demand, economic conditions, and regulatory changes. As HDFC SKY complies with SEBI regulations, it provides investors with valuable tools and insights to make informed decisions. This transparency promotes investor confidence and ensures a secure trading environment.

In addition to SEBI regulations, HDFC SKY must also comply with other regulatory bodies such as the Reserve Bank of India (RBI) and the Ministry of Finance to ensure compliance with broader financial regulations and guidelines. These regulatory bodies oversee different aspects of the financial industry, including margin trading, currency exchange, and compliance with anti-money laundering laws. By adhering to the regulations set by these authorities, HDFC SKY can operate with credibility and integrity, providing investors with a secure and trustworthy platform for their investment needs. Overall, regulatory compliance is essential for low-interest MTFs like HDFC SKY to maintain a strong reputation, protect investors’ interests, and contribute to the overall stability and integrity of the financial markets.

Risks and Challenges Associated with Low-Interest MTF

While HDFC SKY offers a range of benefits and features for investors, there are also risks and challenges associated with low-interest Margin Trading Facility (MTF). One of the primary risks is the potential for higher leverage leading to increased exposure to market fluctuations. Low-interest MTF can tempt investors to take on more risk than they can handle, amplifying both gains and losses. This increased leverage can magnify market volatility, potentially leading to substantial financial losses if the market moves against the investor’s position.

Another challenge with low-interest MTF is the possibility of margin calls. When trading on margin, investors borrow funds from the broker to increase their purchasing power. If the value of the securities held as collateral falls below a certain threshold, the broker may issue a margin call, requiring the investor to either deposit additional funds or sell securities to meet the margin requirements. Failure to meet a margin call can result in the broker liquidating the investor’s positions, potentially at a loss. Therefore, investors using low-interest MTF should be mindful of the risks involved and ensure they have a solid risk management strategy in place to mitigate potential losses.

Case Studies: Successful Implementation of Low-Interest MTF

HDFC SKY, launched by HDFC Securities, is a prime example of successful implementation of a low-interest Margin Trading Facility (MTF). By offering a modern discount-broking platform with a wide range of investment options, including equities, mutual funds, commodities, and global stocks, HDFC SKY has attracted a large number of investors looking for cost-effective trading solutions. The platform’s zero account-opening charges and flat brokerage fee of ₹20 per order, along with lifetime free ETFs, make it an attractive choice for both seasoned traders and newcomers to the market. One of the key highlights of HDFC SKY is its interest-bearing margin trading feature, which allows investors to leverage their investments and potentially increase their returns while keeping borrowing costs low.

Furthermore, HDFC SKY enhances the trading experience by providing expert research insights and intuitive tools that help investors make informed decisions. By combining low-interest MTF with user-friendly interfaces and comprehensive market analysis, HDFC Securities has created a winning formula for successful implementation. The platform’s emphasis on transparency, cost efficiency, and customer support has positioned HDFC SKY as a preferred choice among investors seeking a reliable and affordable trading platform in the competitive financial market landscape.

Future Trends in Low-Interest MTF Adoption

The future trends in low-interest MTF adoption are expected to witness a significant surge in popularity, driven by platforms like HDFC SKY offered by HDFC Securities. As more investors seek cost-effective solutions for trading and investing in various financial instruments, the appeal of low-interest MTFs is likely to grow. HDFC SKY’s innovative approach of offering zero account-opening charges and flat brokerage rates per order makes it an attractive option for both seasoned traders and newcomers to the market. The platform’s inclusion of interest-bearing margin trading adds another layer of flexibility and affordability for users looking to leverage their investments.

Furthermore, as the financial landscape continues to evolve with advancements in technology and changing consumer preferences, platforms like HDFC SKY are well-positioned to capitalize on the growing demand for seamless and user-friendly trading experiences. The integration of expert research and intuitive tools on HDFC SKY provides users with valuable insights and resources to make informed investment decisions. These features, coupled with the platform’s diverse range of offerings including equities, ETFs, mutual funds, and global stocks, are likely to attract a broader audience seeking a comprehensive and cost-effective solution for their investment needs.

Share trading app users will find HDFC SKY’s commitment to innovation particularly appealing. By offering a robust mobile experience, the platform caters to the needs of modern investors who require flexibility and accessibility. The platform’s ability to adapt to market trends ensures it remains competitive in a rapidly changing investment environment.

Key Considerations for Traders Switching to Low-Interest MTF

When traders consider switching to a low-interest MTF like HDFC SKY by HDFC Securities, there are several key considerations to keep in mind. Firstly, the cost structure is crucial as it can significantly impact a trader’s profitability. HDFC SKY offers a flat ₹20-per-order brokerage fee, which is competitive and cost-effective, especially for high-frequency traders. Additionally, the platform features zero account-opening charges, making it accessible for traders looking to minimize upfront costs. The lifetime free ETFs option is also a significant advantage, allowing traders to invest in these instruments without incurring additional charges, which can enhance their investment returns over time. Furthermore, the interest-bearing margin trading facility provides traders with the flexibility to leverage their positions and potentially amplify their gains, although it is important to exercise caution and manage risks effectively when using leverage.

Secondly, the quality of research and tools provided by the platform is essential for traders looking to make informed investment decisions. HDFC SKY offers expert research and intuitive tools that can help traders analyze market trends, identify potential opportunities, and manage their portfolios effectively. Access to comprehensive market data, real-time news updates, technical analysis tools, and customizable dashboards can empower traders to stay ahead of the curve and execute well-informed trades. By leveraging these resources, traders can enhance their trading strategies, optimize their investment performance, and navigate the complexities of the financial markets more confidently. Therefore, when considering a switch to a low-interest MTF like HDFC SKY, traders should carefully evaluate the platform’s research and tools to ensure they align with their investment objectives and trading style.

Expert Insights: Perspectives on the Importance of Low-Interest MTF

Low-interest margin trading facility (MTF) plays a crucial role in the investment landscape for both seasoned traders and novice investors. Experts highlight the significance of low-interest MTF as it empowers investors to amplify their market exposure without requiring substantial capital upfront. HDFC SKY, with its interest-bearing margin trading feature, enables investors to leverage their investment potential by borrowing funds to expand their portfolio. This facility not only enhances trading opportunities but also allows investors to diversify their holdings and potentially increase returns. The low-interest aspect is particularly beneficial as it helps in reducing the overall cost of borrowing, making it an attractive option for traders looking to optimize their capital efficiency.

Furthermore, the availability of low-interest MTF on HDFC SKY serves as a valuable tool for risk management in the volatile financial markets. By providing access to margin trading at competitive interest rates, the platform equips investors with the flexibility to manage market fluctuations and seize opportunities in a dynamic trading environment. Expert perspectives emphasize that the ability to trade on margin with low-interest rates can help investors navigate market uncertainties with greater confidence and agility. This feature not only enhances trading strategies but also facilitates strategic decision-making by enabling investors to adapt to changing market conditions effectively. Overall, the importance of low-interest MTF on platforms like HDFC SKY lies in its ability to empower investors with the tools and resources needed to optimize their trading experience and achieve their financial goals.