Most retail investors show interest in CSK, an IPL franchise for investment due to its positive financial metrics including operating revenue and profit. Chennai Super Kings comes on the top list with positive trends, impeccable performance, and high brand value. In the unlisted share market, investors generally look for the best-growing company with high revenue; CSK definitely has an edge over other companies in terms of various aspects. Does investing in CSK’s pre-IPO shares benefit retail investors? Let’s find out the overview in the blog.

CSK Pre-IPO Shares Details

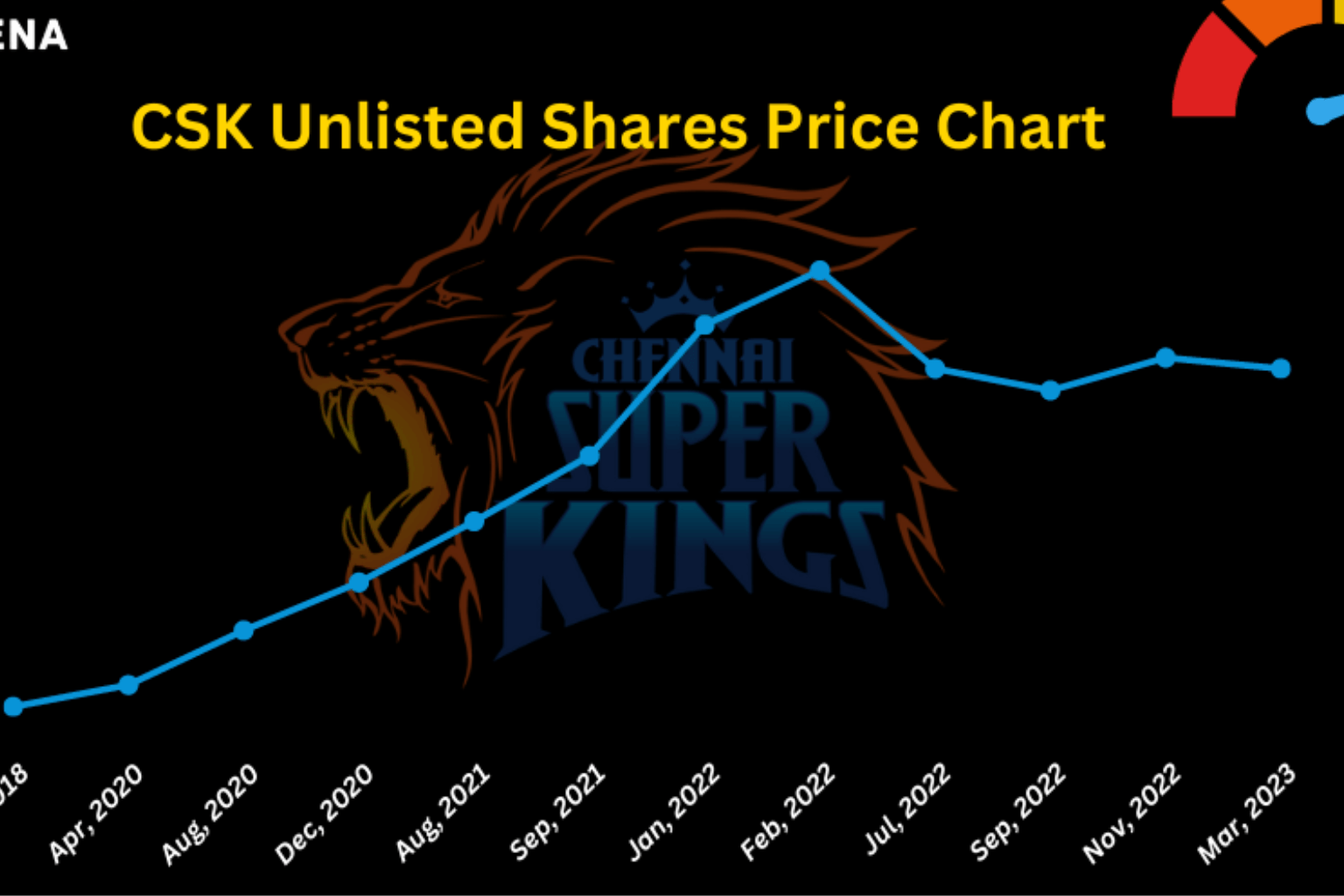

The unlisted share market is unpredictable; however, in the last three financial years, CSK’s financial metrics have shown favourable changes. However, the company’s performance in the IPL tournament largely affects the CSK share price. Let’s look at CSK’s pre-IPO share details to assist you with their investment decisions.

| Name | Chennai Super Kings Cricket Limited |

| Demat Status | NSDL, CDSL |

| CSK Unlisted Share Price | INR 193 per share |

| Market Cap | INR 5,331 crore |

| Total number of shares | 30,81,53,074 shares |

| Face Value | INR 0.10 per share |

| ISIN Code | INE852S01026 |

| Lot Size | 100 shares |

What Benefits Investors Get By Investing In CSK Pre-IPO Shares?

Chennai Super Kings performance improves over the years in the unlisted market. It evokes retail investors’ attention towards buying CSK pre-IPO shares to earn high return on investment. Here are the best reasons why CSK will be a viable investment option for you:

High Return on Investment

Investing in CSK pre-IPO shares can provide an advantage of high returns as the frequency of overpricing and undervaluation stays longer in the unlisted share market. One of the reasons is limited investor intervention; as the company still needs to be listed, there is a high chance of sizable returns.

Scope of Risk Diversification

Retail inventors with portfolios in listed stocks can also invest in CSK shares for risk diversification. Under the unlisted share market, the risk dynamics are different, and CSK is showing unbeatable progress that mitigates the risk.

Limited Price Competition

Unlike the listed market, where the demand and supply flow are large, investors can enjoy price negotiation with CSK unlisted shares. Limited buyers and sellers add benefits to lower the CSK share price, so in the long run, when the price goes up, there will be huge profits for investors.

Business Expansion

Recently, CSK planned to borrow Rs. 350 crore for investment into future growth. Investors can expect more business expansion initiatives that might scale up the CSK share price in the coming months.

CSK Pre-IPO Shares: A Profitable Investment Option!

So, the investors have good reasons to look at CSK unlisted shares to diversify their investment portfolio. Despite the fluctuation in the unlisted share market, CSK share prices have been actively increasing in recent years and currently traded at Rs. 193 which will add value to investors. Are you looking for updated Chennai Super Kings share price in the unlisted share market? Count on Stockify for checking the updated share price and start your investment journey hassle-free.